Grow Your Real Estate Business

InstaLend is your private lending partner. Tell us about your project. We can get you a loan commitment the same day and close within days.

About Us

InstaLend empowers real estate operators to get access to capital at lower rates in far less time than they would with alternative lenders.

Peace of Mind

We show up for closing every time and serve as reliable capital partners

No Income Requirements

Since our loans are asset-based, we do not ask for income verification

Minimal Paperwork

Our streamlined processes make it easy for you to close loans with minimal paperwork

No Upfront Fees

We charge no upfront fees to begin processing your loan application

No Prepayment Penalties

Pay back the fix & flip loans without incurring any pre-payment penalties

Fast Approval & Funding

We typically get to the closing table within a week of receiving the appraisal report

Loan Programs

With its competitive rates and diverse loan programs InstaLend meets all your short-term and long-term investment needs.

- Fast lending for your first or fiftieth real estate investment

- We know how to customize loans to support the specialized needs of each investment

- Knowledgable in-house experts help you every step of the way

| Fix & Flip | Rental Loan | Bridge Loan | New Construction | |

| Description | For newbie and experienced property flippers. Upto 90% of purchase+ 100% of rehab costs |

For long term purchase or refinance including cashout. Property can be vacant |

For newble and experienced property owners. Short term loans to refinance or cashout |

Must have previous new construction experience or be a licensed General Contractor |

| Loan amount | $50,000+ | $75,000+ | $50,000+ | $50,000+ |

| Loan term | 12 months | 30 years | 12-24 months | 12 months |

| Minimum FICO | 620 | 680 | 650 | 650 |

| Interest rate | 10.5%+ | 6.5%+ | 10.5%+ | 10.5%+ |

| LTARV | 70% | 80% | 80% | 70% |

| Pre-payment penalty | ✖ | ✓ | ✖ | ✖ |

| Borrower experience | ✖ | ✖ | ✖ | ✓ |

| Property types | Single-family(1-4 units), Condo, Multi-family, Mixed-use |

Single-family(1-4 units), Condo, Multi-family, Mixed-use |

Single-family(1-4 units), Condo, Multi-family, Mixed-use |

Single-family(1-4 units) |

| Apply | Apply | Apply | Apply |

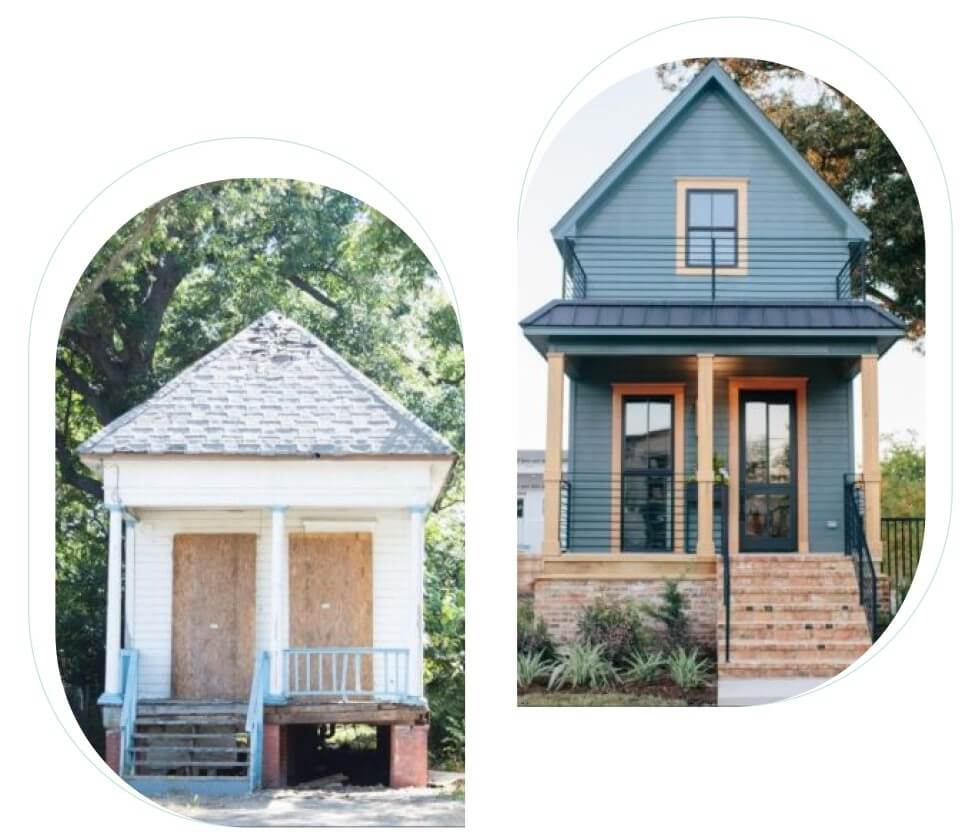

Our Clients' Before and After Projects

Before

After

Before

After

Before

After

Before

After

Before

After

Before

After

Before

After

Client Testimonials

Great product options for different types of real estate investors. I have used both short term financing and 30-year fixed loans. The team at InstaLend are very knowledgeable in not only the finance part of the deal but every aspect of the transaction.

Keshia R

Detroit

I have closed multiple deals with the team at InstaLend, and my experience can be described in one word: AMAZING. In addition to receiving the best loan programs and rates, the customer service, responsiveness and & high sense of urgency to fund your deal is like nothing I’ve experienced before with a lender. For good reason, I have - and will continue to - recommend InstaLend to all investors looking for funding on their next deal.

Michael L

Illinois

With the help of InstaLend I have been able to grow my property flipping business by two-fold. Everything from acquisition, construction draws and all the way to final pay off moves along very smoothly.

John G

Florida

I used InstaLend for a deal I needed to close quickly on. They were able to get everything ready in a very short period of time. Would highly recommend!

Andrew G

Detriot