Building a home or commercial space from scratch in Georgia is a big goal—but it’s not out of reach. Whether you’re looking to construct your forever home in the Atlanta suburbs or build a small retail center in Savannah, you’ll need the right financing to get started. That’s where new construction loans come in.

According to recent market data, the average home value in Georgia has climbed over $380,500, and demand for housing continues to rise in metro areas and surrounding counties. With increasing land prices, labor costs, and materials, it's more important than ever to secure the right funding up front.

That’s where many would-be owners run into problems. You need something flexible enough to fund the build—step by step. Let’s find out how new construction loans are perfect for your dream property.

What Are New Construction Loans?

New construction loans are short-term, interest-only loans used to finance the cost of building a new property. Unlike a traditional mortgage—which is issued after a home is built—these loans fund the process from the ground up.

These hard money loans typically cover:

- Land purchase (if not already owned)

- Labor and materials

- Permits and inspections

- Builder’s Insurance

- Contingency funds for unexpected costs

The loan is disbursed in stages, known as “draws,” which coincide with construction milestones—foundation, framing, roofing, and so on. Once the project is complete, the borrower can either refinance into a permanent mortgage or pay off the loan using sale proceeds (for builders and investors).

Who Should Consider a New Construction Loan?

This type of loan is ideal for:

- Homeowners building custom homes

- Real estate investors constructing multi-family units

- Business owners developing commercial properties

If you're building in Georgia and need structured, short-term financing to get your project off the ground, new construction loans are likely your best option.

What You Need to Qualify in Georgia

Getting approved for new construction loans for your dream property involves more paperwork than a standard mortgage. Lenders need to see that your project is feasible, legal, and financially supported.

Here’s what most Georgia-based lenders will require:

1. Solid Credit Score

Lenders typically want to see a credit score of 680 or higher. Lower scores might still be considered—but often at higher interest rates.

2. Strong Down Payment

Expect to put down at least 20–25% of the total project cost. This minimizes the lender’s risk and shows that you’re financially invested.

3. Detailed Construction Plans

You’ll need to provide a full construction plan, including:

- A clear construction timeline

- A line-item budget

- Architectural drawings or blueprints

- Contractor agreements

4. Licensed and Insured Builder

Lenders will require you to work with a qualified general contractor. If you plan to self-build, expect extra scrutiny. Most hard money lenders in Georgia won’t fund DIY home construction.

5. Permits and Site Approval

You’ll need local government approvals and permits before the first dollar is disbursed. No permit = no funding.

Considering Hard Money Loans for New Builds

If you don’t meet the criteria for traditional construction financing—or need fast access to capital—you may want to consider hard money loans.

A hard money lender offers funding based on the value of the property, not the borrower’s creditworthiness. These loans typically have higher interest rates and shorter terms, but they move quickly and are easier to qualify for.

Hard money loans are a solid option for:

- Investors flipping new builds

- Builders working on spec homes

- Borrowers with a limited credit history

For high-potential construction projects that need to get moving fast, they’re often worth the higher cost.

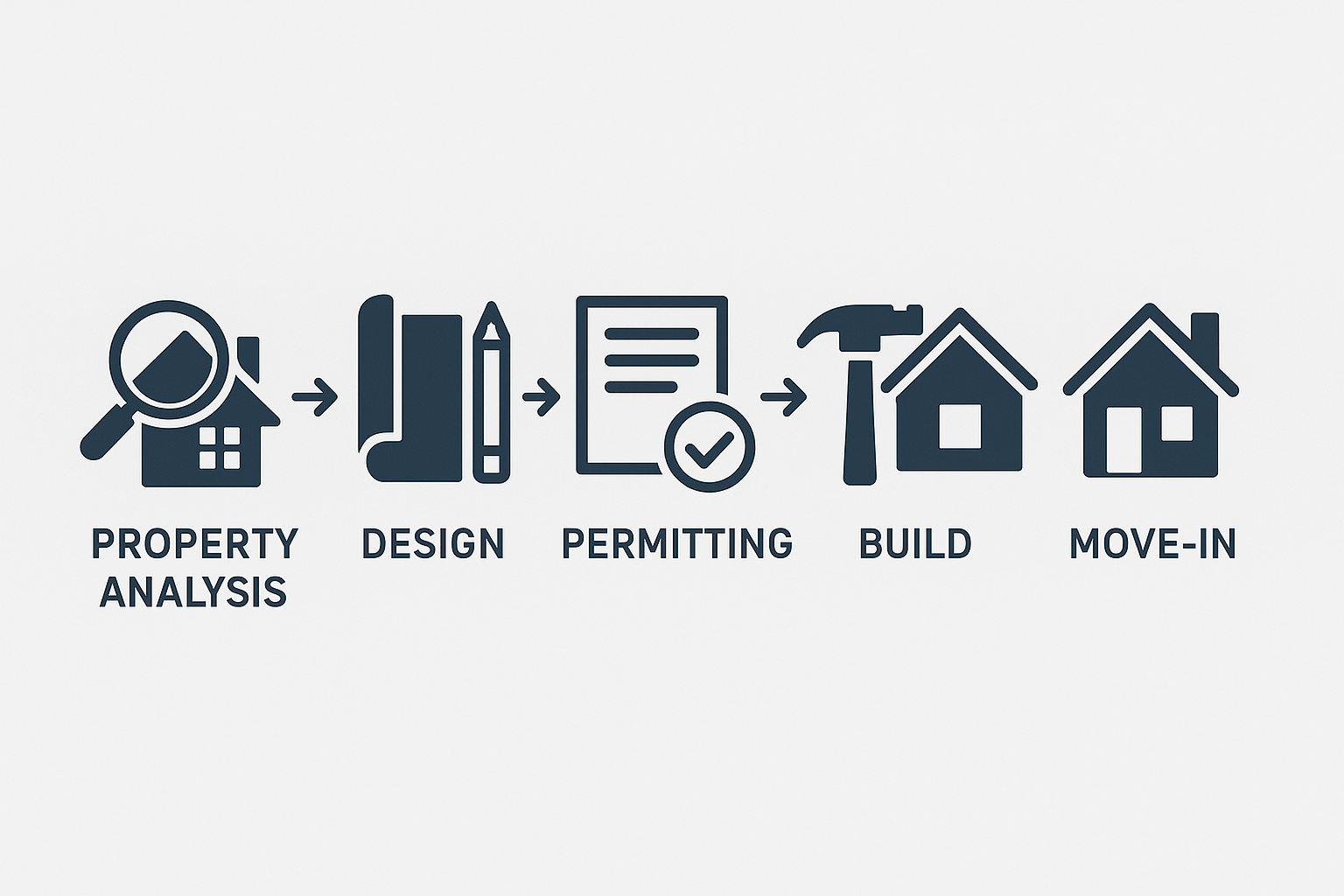

Steps to Secure New Construction Loans in Georgia

Here’s a step-by-step guide to help you secure new construction for your dream property:

1. Assess Your Budget and Goals

Before applying, you should have a clear idea of how much you’ll need and how you’ll repay it. Will you sell the property after completion? Will you refinance into a mortgage? Build your plan before you build your house.

2. Choose a Qualified Builder

Hard money lenders in Georgia often reject applications if the builder isn’t licensed or experienced. Work with someone who’s familiar with local codes and has a strong project portfolio.

3. Prepare Your Documentation

Gather:

- Your credit report

- Bank statements

- Building plans

- Site surveys

- Cost estimates

- Proof of down payment funds

The more complete your file, the faster you’ll get approved.

4. Get the Right Loan Type

Discuss options with lenders to determine which product fits your build. Some lenders offer construction-only loans, while others offer construction-to-permanent loans that convert to a mortgage automatically when the project finishes.

5. Close and Start Building

Once approved, you’ll close on the loan and start construction. Funds will be released as each phase of the project is completed and inspected.

Tips to Increase Approval Chances

- Work with local hard money lenderswho understand Georgia markets.

- Don’t underestimate costs—build in a 10–15% contingency.

- Stay organized with timelines and contracts.

- Avoid delays—missed deadlines can stall funding.

Partner With InstaLend To Get New Construction Loans for Your Dream Property

Ready to build your dream property in Georgia? InstaLend offers fast, flexible new construction loans in Georgia designed for both homeowners and investors. Whether you're building a new home or launching a commercial project, we’re here to finance your success—one phase at a time.

Apply today to get approved and take the first step toward turning your vision into a finished structure.