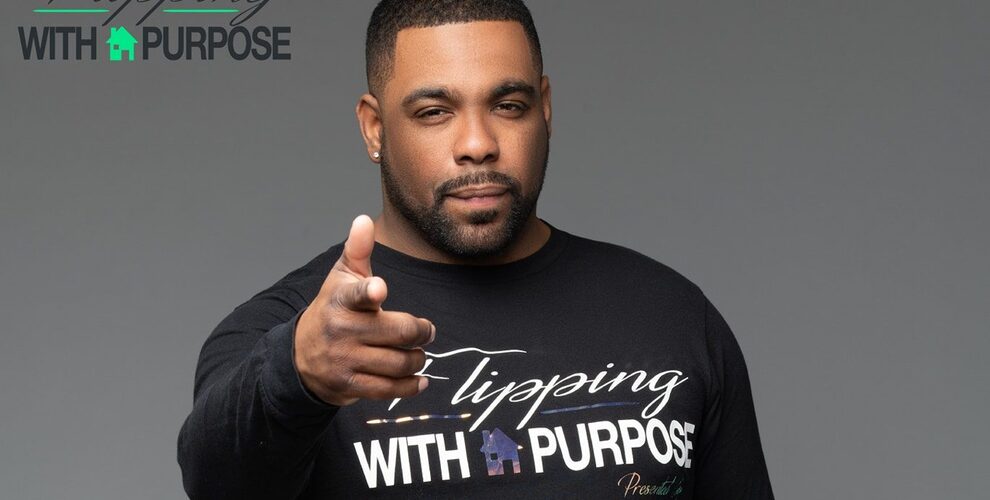

Keith Jones – Learnings From 20+ Years of Distressed Property Investing

Please introduce yourself.

My name is Keith D. Jones Sr and our company is Eking LLC. We have a total of 6 members who are all independent investors as well, all projects are not done as a team we are all free to take down other projects as well. We have all been investing in some way for years now, but we decided to form a company for bigger projects and multiple purchases. I have worked in the real estate and mortgage default business for over 20 years, primarily in distressed properties. As a team, we focus on Jacksonville and the surrounding areas, but independently our team members are all over the country making investment deals.

How did you get started in the real estate business?

I first obtained a real estate license in 1999 and worked for a small brokerage here in Jacksonville, FL. I worked as a real estate agent at a company called Option One Mortgage in the default section. We were producing short sales and loan modifications back in 1999 and 2000 before the crash, so I had a good understanding of short sales back then. It wasn’t until the crash happened that I understood how many investors were able to bolster their portfolio during that market crash and how they turned a bad situation into a good situation by buying and reselling those homes. That market crash taught me that real estate was and still is the most stable investment you can ever make because no matter how much the market goes up and down, a home is a must-have.

What are some hot markets for real estate that you are excited about?

We’re primarily in Florida now but looking to go into Detroit, Milwaukee, Nevada (Henderson, Reno, Las Vegas), Phoenix, AZ, and Texas (Austin, Dallas, and Houston). By numbers, these places are heavily populated with lots of investor activity. Nevada is pretty much the new California because no one can afford to live in Cali, so investors are doing pretty well out there.

How do you source your real estate deals?

We score our deals by using the Net Income approach which is gross profit minus expenses. It’s a very simplistic approach but it checks all the boxes we need checked, because at the end of the day with a single family it’s about the net. Multifamily homes we all have a different feel for. I would take a 300-dollar minimum on a 4 unit depending on the deferred maintenance on it prior to purchase. We generally want at least 500 per month minimum, before expenses for each single-family purchase we hold. With the multi-units I am willing to take a little less to obtain the property and work to raise the rents in the future, but we are all taking a different approach individually on those.

What are some checks and balances you’ve put in place to protect your real estate transactions?

Due to the size of the group, everyone has their role in the group when we take on projects. The group treasurer’s job is to make sure the accounting is up to date, and the treasurer is the only one allowed to cut checks to the contractor (I can, but I do not). It is my job to give the OK to pay for anything beyond a monthly bill we have set up, like the credit card for the business, which is paid automatically because we have to pay it. Contractor contracts are based on work progress. We do not give contractors half now and half later, but they get paid as they complete certain items on the same item sheet they bid on. After each section of work is completed, it is our contractor manager’s job to verify if the contractor should be paid for that job and contact me with pictures or videos to give the okay. Only two members of the group are allowed to withdraw money from the bank account, and that is the treasurer and me.

What is one piece of advice you would give someone starting their real estate career?

If you’re looking to get into real estate, I would strongly recommend that you work with someone first. I did not do that and there wasn’t a lot of help when I first started in real estate, so we went through the white pages to find expired owners. I spent a lot of money on things that never worked and lost a lot of time, but I did gained knowledge the LONG WAY! When you work with someone, you can learn very quickly. We often think of the financial aspect and that the employer is earning a certain percentage from you, and that you need to constantly check that split. You should be more concerned with what you learn and how much you save by using the employer’s resources and not experimenting with your own, because they have already done that for you. If you insist on doing it on your own, you have to be willing to accept all the ups and downs, and in the beginning it’s mostly downs.

What is one software you use for your business and recommend to others?

Our software is Batchleads and we are now moving into using Propstream. We also use a lot of old-fashioned spreadsheets.

What is your superpower in life?

My forte is default mortgages and distressed properties. I have taught short sales at every brokerage I have worked for, and I have held Operation Manager positions for JP Morgan Chase handling all their court-ordered short sales. I am the best in the industry at default mortgages and taking short sales from the bank.

What is a failure you’ve had in life that set you up for eventual success?

For anyone who has a 9-5 job, my biggest regret is that I allowed them to lay me off and I did not leave on my own. When I was laid off from my 9-5 job, I had a bitter taste in my mouth because I felt like I gave it my all and they just saw me as a number. That reinforced that I never wanted to go back, so I knew real estate had to work, I had no choice but to win. Getting laid off is not a failure, but it sure as hell feels like it.

What is one book that has influenced your life the most? Why?

The one book I would like to recommend to everyone is called “The Tribe of Millionaires”. This book made me evaluate myself and everyone around me.